Gamifying Financial Literacy through mobile application | Conversational Design with FinPal AI

01. Overview

Empowering NRI Millenials and Gen Z in the United States. According to the Ministry of External Affairs of India, 13.4 million NRIs reside outside India. Users between the ages of 22 and 40 years are the biggest demographic group of NRIs belonging to Millennial and Gen Z group.

Role

UX Design, UX ResearchTeam

Pooja - Capstone Project

Timeline

6 WeeksTools

Mural, Figma, Webex (interviews), PitchProject Overview

Inadequate financial understanding is an international problem. “Earning millions” isn’t the problem, Understanding is… The exponential NRI growth, unique needs, lack of tailored solutions, critical life decisions, and growing product availability.

03. Problem DiscoveryThe Problem? Turns out, Millennials and Gen-Z lack the confidence in attaining their financial goals…

Problem Space

Heightened level of financial literacy demand - Lack of deeper level of financial knowledge due to their unique circumstances.

Complexity vs Accessibility - A proposed mobile application, PocketFin aims to address this by providing bite-sized and engaging content to make complex financial topics more accessible

Solution

Build an intuitive and user-friendly interface that will make financial concepts accessible to users and provide resources to educate individuals in the most simplest form, it will empower them to be more aware of financial world on their newsfeed and improve their financial attitude like planning, goals, freedom through PocketFin

Why is this problem important?

86%

of surveyed NRI users admit being less confident in taking financial decisions

65%

of users have felt that if they had received right learnings then they could have attained financial goals earlier

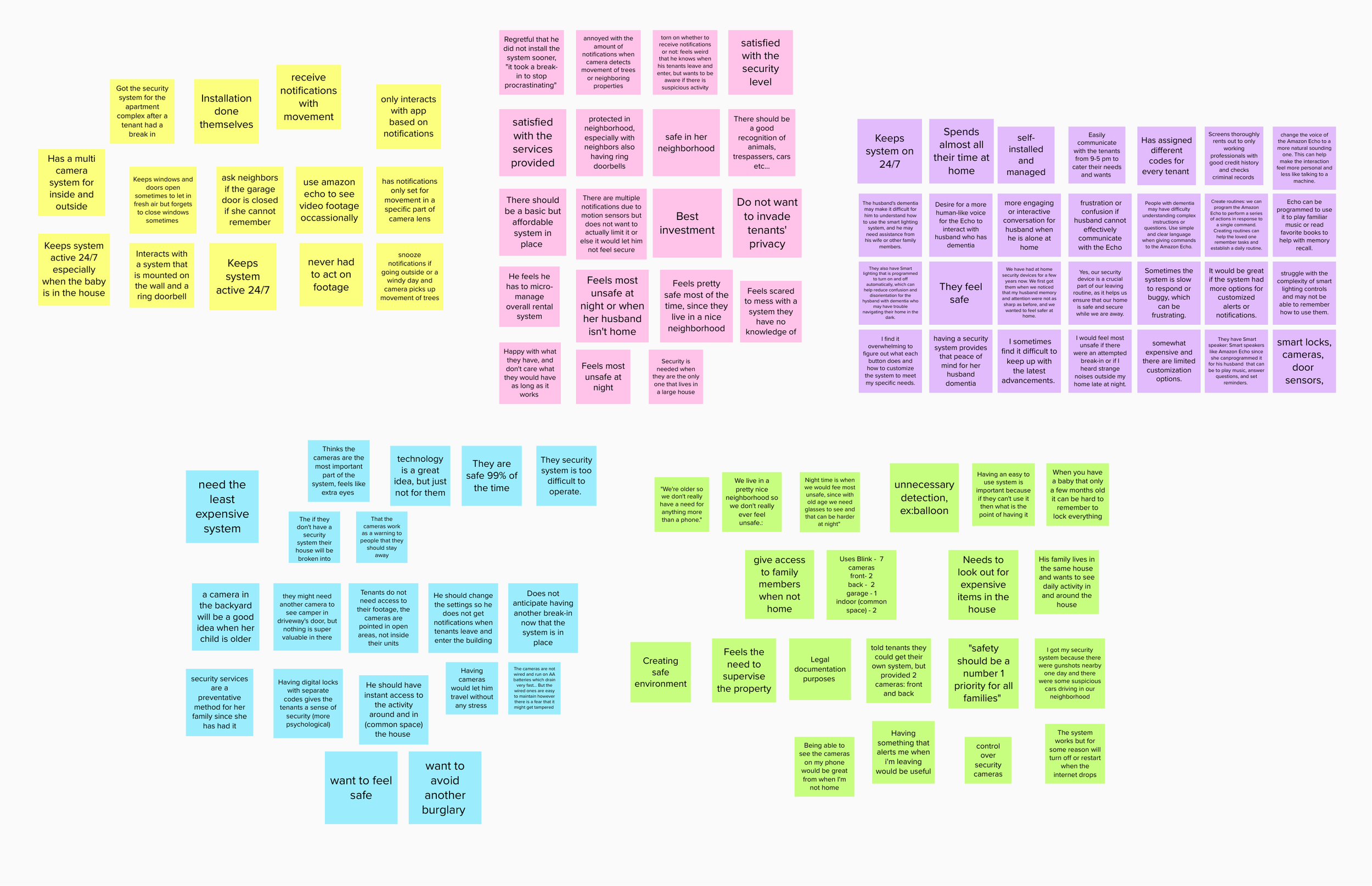

04. ResearchFiguring Out What Financial Literacy Really Means for NRIs

I conducted 3, 30-40 minutes semi-structured interviews (focusing on NRIs in the USA) to gain insights on what financial literacy means to our participants and current user pains and needs on their methods of gaining knowledge. We wanted to learn how individuals can be empowered to make financial decisions.

Research Goals

The goal was to investigate how NRIs were making financial decisions and planning their financial freedom through a user interview

Research Insights

From here I asked the question: what could help NRI users overcome these barriers?

Opportunities

Centralized Accessibility

Consolidation of relevant financial information, addressing the fragmented nature of existing tools.

Inclusive Design

System should be inclusive, catering to diverse user profiles and their specific financial literacy needs

Tailored Educational Content

Users seek personalized and context-based information breakdown to enhance their understanding of financial concepts.

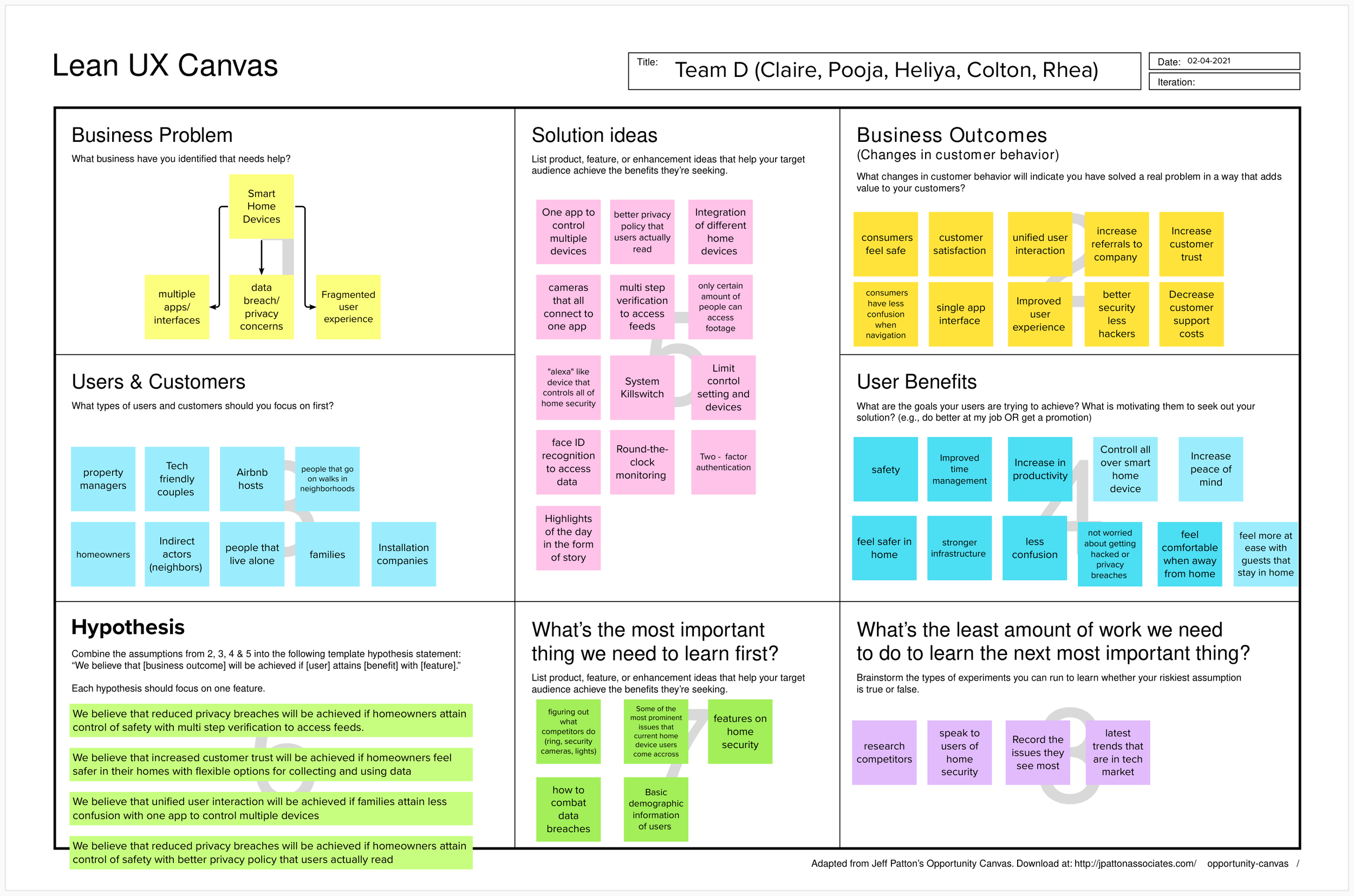

05. IdeationCan Gamification help users learn making their financial decisions?

Taking what I learned from the research, I brainstormed various ideas surrounding new ways to engage users. We then did the crazy 8's exercise in which I drew inspiration from sources such as Trivia and Duolingo for my initial sketches. The intersection of all of our ideas was a gamified rewards app made specifically for learning modules to gauge user interaction and their affinity.

Standing out Amongst the Crowd: Market Research Insights

To strengthen the ideas, I looked at several competitors for rewards apps. I created a chart that reflected several opportunities in the market: non-monetary incentives, community based and socially relevant activities.

06. DefineTailoring the experience for NRI Millennials and Gen-Z…

PERSONA

Developing Features that Satisfy User and Business Objectives

The final features aim to satisfy the needs of both users and businesses, resulting in increased engagement, customer retention, and revenue.

07. COLOR PALETTE, USER FLOW, & WIREFRAMES

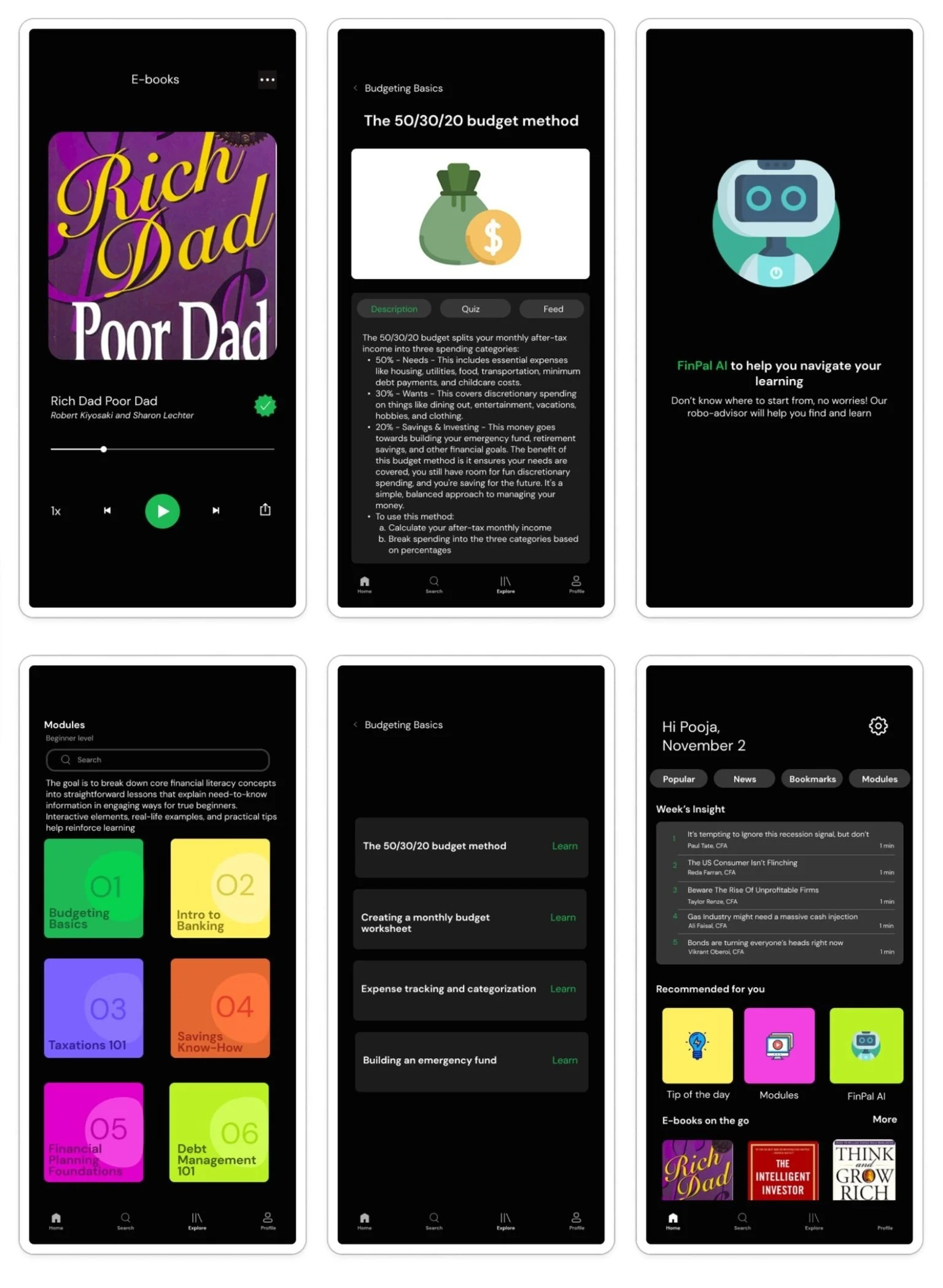

08. IDEATIONPaper mockups

Splashscreens

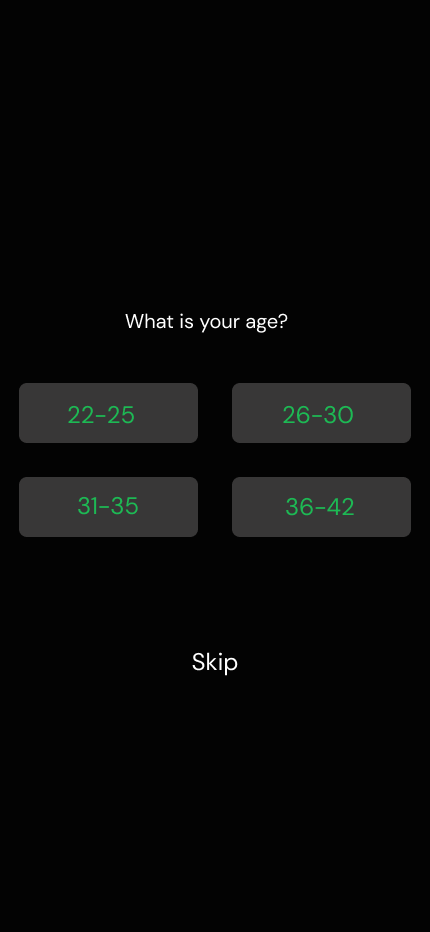

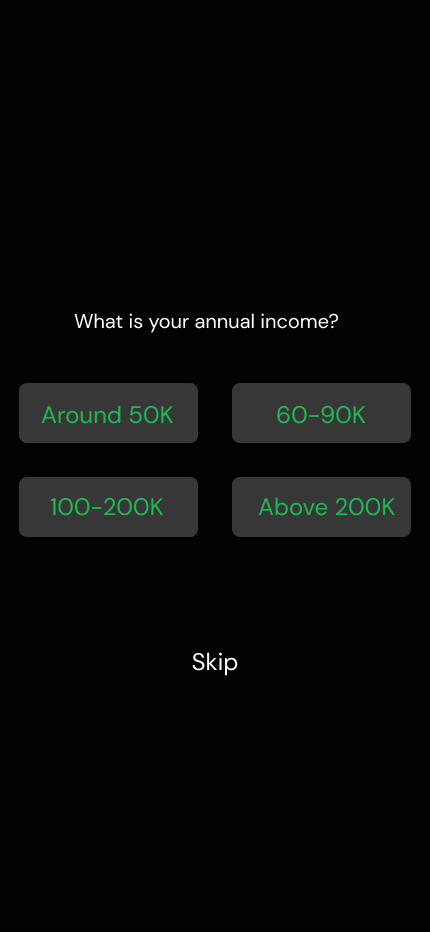

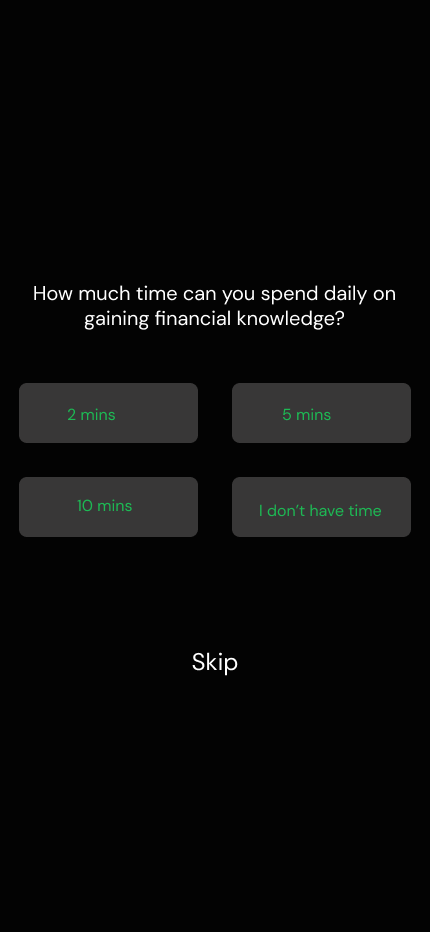

Onboarding Screens

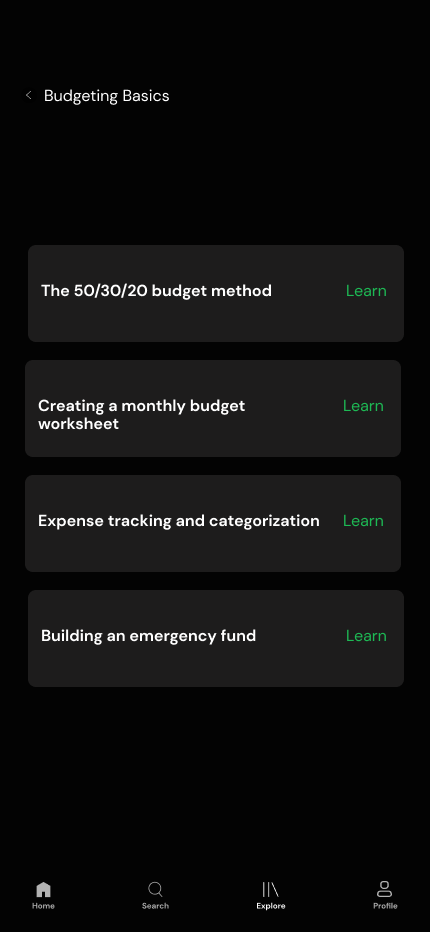

Module & E-book

AI Robo Advisor

Quiz

06. EvaluationTo evaluate the user experience, privacy, security, and fragmentation concerns of the smart home security solution

Usability Testing Feedback

01 - Participants like simple, minimal UI design

02 - The quiz and modules were seen interactive and engaging

03 - The chatbot provided helpful guidance to users

User Feedback

07.ReflectionWhat I learned

One of the main challenges was balancing simplicity with functionality. Users wanted a straightforward app, but also desired various features. To address this, I prioritized core functionalities and used a minimalist design approach. This ensured the app remained user-friendly while still offering essential features. I also learned the importance of presenting my ideas clearly and concisely. If I had more time, I would explore integrating social features to allow users to share their progress and motivate each other. Additionally, I would conduct further research to identify additional features that could enhance user engagement and satisfaction. The key lessons I learned from this project include the importance of user research, iterative design, and effective communication. These lessons will undoubtedly inform my future work in UX design and help me create better user experiences.